Profiting from Cryptocurrency Spot Trading:

Table of Contents

- Introduction to Spot Trading

- Choosing the Right Exchange

- Understanding Market Mechanics

- Tools and Indicators for Spot Trading

- Developing a Winning Strategy

- Managing Risk in Spot Trading

- Case Studies and Real Examples

- Using Data and Charts to Improve Accuracy

- Common Mistakes and How to Avoid Them

- Tax Implications and Legal Considerations

- Resources and Platforms

- Conclusion

1. Introduction to Spot Trading

Spot trading is the most fundamental form of crypto trading where traders buy and sell cryptocurrencies at real-time prices, taking immediate ownership of the asset. Unlike futures or margin trading, there's no borrowing or contract agreement; you own what you buy instantly.Table 1: Comparison of Spot vs. Futures vs. Margin Trading

| Feature | Spot Trading | Margin Trading | Futures Trading |

|---|---|---|---|

| Ownership | Yes | Yes (via leverage) | No (contract only) |

| Leverage | No | Yes | Yes |

| Settlement Time | Immediate | Immediate | Future date |

| Risk Level | Medium | High | Very High |

2. Choosing the Right Exchange

Selecting a secure and efficient exchange is the foundation of successful spot trading.Key Features to Consider

- Security: Ensure the platform uses cold storage, 2FA, and has no history of hacks.

- Trading Fees: Lower fees maximize your profit margins.

- Liquidity: High liquidity means tighter spreads and faster order execution.

- User Interface: A user-friendly interface reduces errors and boosts efficiency.

- Customer Support: Critical in case of technical issues or fund delays.

| Exchange | Security Rating | Avg. Fee | Supported Coins | Liquidity Rank |

|---|---|---|---|---|

| Binance | A+ | 0.1% | 350+ | 1 |

| Kraken | A | 0.26% | 200+ | 4 |

| Coinbase | A- | 0.5% | 150+ | 2 |

3. Understanding Market Mechanics

To profit in spot trading, it’s essential to grasp how order books, spreads, and liquidity work.How Spot Markets Work

Spot markets operate via an order book system where buyers and sellers place bids and asks.Key Concepts:

- Bid-Ask Spread: The difference between the highest price a buyer is willing to pay and the lowest price a seller will accept.

- Market Order: Executes immediately at current price.

- Limit Order: Executes only at a specific price.

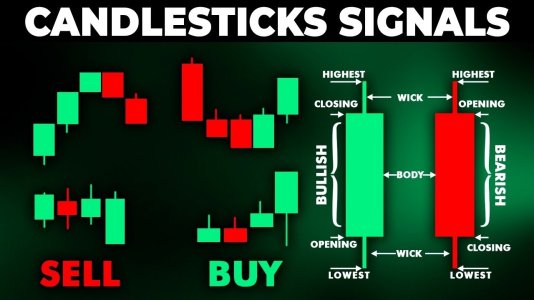

4. Tools and Indicators for Spot Trading

Technical tools help traders make data-driven decisions.Must-Have Tools

- Moving Averages (MA)

- Relative Strength Index (RSI)

- MACD (Moving Average Convergence Divergence)

- Fibonacci Retracement Levels

5. Developing a Winning Strategy

Types of Strategies

- Day Trading: Multiple trades per day.

- Swing Trading: Hold positions for days or weeks.

- HODLing: Buy and hold long-term.

- Scalping: Dozens of trades within minutes or hours.

Dollar Cost Averaging (DCA)

An effective long-term strategy. Invest a fixed amount at regular intervals.Table 3: DCA vs Lump Sum Investment Comparison

| Strategy | Average Buy Price | Volatility Risk | Emotional Stress |

|---|---|---|---|

| DCA | Lower Over Time | Medium | Low |

| Lump Sum | Higher If Early | High | High |

6. Managing Risk in Spot Trading

Tips for Risk Management

- Never invest more than you can lose

- Use stop-loss and take-profit orders

- Diversify your portfolio

- Avoid trading during high-volatility news events

7. Case Studies and Real Examples

Case Study: $1,000 to $4,200 in 12 Months

- Trader: Alice

- Method: Swing trading top 10 coins with DCA

- Tools Used: TradingView, CoinMarketCap alerts

Loss Scenario: Ignoring Stop-Loss

- Trader: Bob

- Error: Held onto a tanking altcoin, lost 70%

- Lesson: Always apply stop-loss.

8. Using Data and Charts to Improve Accuracy

Sources of Reliable Market Data

- CoinMarketCap

- CoinGecko

- Glassnode

- Santiment

9. Common Mistakes and How to Avoid Them

Mistakes

- Overtrading

- Ignoring fundamentals

- Emotional decisions

- Not tracking trades

- Stick to a strategy

- Keep a trading journal

- Use automated alerts

10. Tax Implications and Legal Considerations

Crypto Tax Basics

- Capital Gains Tax: Applies to profits made.

- rHolding Period Matters: Long-term vs short-term tax rates.

- Track Everything: Use tools like CoinTracker or Koinly.

Legal Tips

- Use KYC-verified platforms

- Stay updated on regional crypto laws

| Country | Short-Term Gains | Long-Term Gains |

|---|---|---|

| USA | 10–37% | 0–20% |

| Germany | Tax-free after 1 year | Tax-free |

| Australia | 19–45% | 0–23% |

11. Resources and Platforms

Top Platforms

- Binance

- https://accounts.binance.info/register?ref=18282102

- Kraken

- Coinbase

- KuCoin

Learning Resources

- Investopedia

- Bitpanda Academy

- BabyPips Crypto Section

12. Conclusion

Spot trading is a powerful way to profit from the cryptocurrency market when approached with the right tools, discipline, and mindset. Whether you're a beginner or experienced investor, a consistent strategy, risk management, and continued learning are key to long-term success.Final Tips:

- Stay updated on market trends.

- Keep emotions in check.

- Continuously evaluate and refine your strategy.